In a dramatic turn of events on February 21, 2025, the cryptocurrency industry witnessed one of its largest security breaches—a staggering $1.4 billion hack targeting Bybit. The incident, which has gone down in history as the largest crypto heist, has, surprisingly, also become a showcase of unity and cooperation within an often fiercely competitive field.

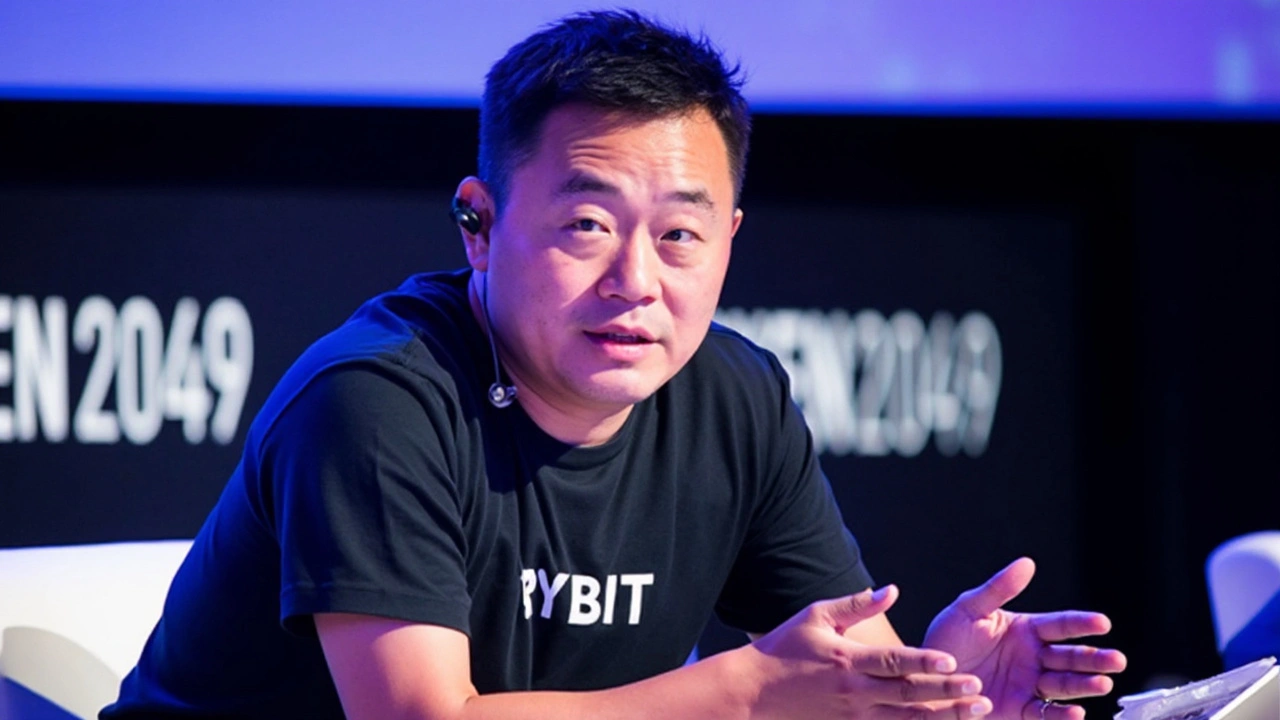

Bybit's CEO Ben Zhou, during a heartfelt livestream, expressed profound gratitude to various firms and leaders across the crypto space for their invaluable support and assistance. Among those singled out were Antalpha Global, Bitget, Pionex, MEXC, and several others, including industry heavyweights like Galaxy Digital and Tether.

From Crisis to Collaboration

In the face of this unprecedented challenge, the spirit of collaboration was clearly evident. Bitget emerged as a frontrunner, being the first to loan Ether to Bybit. They also took swift action by blacklisting the hacker's wallets, demonstrating proactive measures in crisis management.

Crypto.com was another key player, with CEO Kris Marszalek stepping in to offer the company's cybersecurity resources in aid of Bybit's recovery efforts. This gesture underscores the industry's growing maturity when it comes to handling crises collaboratively rather than solely viewing one another as competitors.

Ensuring User Security

Amid the chaotic scenario of the hack and its aftermath, users were understandably concerned about the security of their funds. Bybit's independent auditor, Hacken, played a pivotal role in reassuring both the company and its users. Their audit confirmed that despite over $5.3 billion in withdrawals, user funds remained fully backed—a testament to the resilience and robust practices of Bybit's financial management.

This massive breach has not only necessitated individual security reassessments within firms but has also spurred a wider industry introspection. The incident has prompted a reevaluation of cybersecurity measures across the board, encouraging firms to think more collectively about how to prevent such events in the future.

CEO Ben Zhou encapsulated the sentiment of the industry well when he stated, "With this level of unity in this space, we know we’ll come back even stronger." His words reflect a broader realization among crypto firms that in times of crisis, collaboration can indeed be the key to resilience and future success.

Comments

We must view this unprecedented event not merely as a setback but as a catalyst for strengthening communal defenses across the crypto ecosystem. By fostering transparent collaboration, each participant can contribute unique expertise, ensuring that future threats are mitigated more efficiently. Let us commend the swift assistance rendered by Bitget, Crypto.com, and the audit firm Hacken, whose actions exemplify the collective responsibility we all share. United efforts such as these lay the groundwork for a more resilient infrastructure, benefitting both users and providers alike. I encourage all stakeholders to continue this spirit of mutual support and to institutionalize cross‑platform communication channels for rapid response.

What this saga starkly illustrates is the paradox of competition and interdependence that underpins the very fabric of decentralized finance. While firms vie for market share, the underlying technology binds them in a shared destiny; a breach to one reverberates through the entire network. Therefore, the aggressive outreach by Bitget and the open‑handed aid from Crypto.com should not be seen as charitable gestures but as strategic imperatives for sector‑wide stability. If we ignore this reality, we risk fragmenting the ecosystem into isolated silos, vulnerable to repeated assaults. Let us, therefore, embrace an ethos where solidarity becomes the default operating mode, not an occasional response to crisis.

Wow, talk about turning a nightmare into a team‑building exercise! 😃 Seeing so many heavyweights step up fast is truly heartening-it's like the crypto community finally found its rhythm of helping each other out. With Bitget throwing Ether and Crypto.com sharing security tools, we’re watching a real‑life superhero squad in action. This kind of unity gives me hope that even the biggest hacks can become lessons that push us forward. Keep the good vibes rolling, folks! 🚀

From an operational risk management perspective, the Bybit incident underscores the criticality of integrating multi‑layered defense mechanisms that span both on‑chain and off‑chain vectors, thereby necessitating a holistic approach to threat modeling that encompasses not only external adversaries but also potential insider contingencies. The immediate mobilization of liquidity by Bitget, specifically the deployment of Ether as an emergency bridge asset, illustrates a practical application of liquidity fragmentation mitigation strategies that can be orchestrated through decentralized finance protocols without compromising capital efficiency. Moreover, Crypto.com’s provision of cybersecurity resources exemplifies a collaborative defense‑in‑depth architecture, wherein shared threat intelligence feeds accelerate the detection and remediation of anomalous transaction patterns, effectively reducing mean time to detection (MTTD) and mean time to response (MTTR). The involvement of Hacken as an independent auditor introduces an additional assurance layer, facilitating a verifiable audit trail that aligns with regulatory compliance frameworks such as FATF Recommendations and the evolving standards of digital asset custodianship. It is paramount that post‑incident analyses incorporate rigorous forensic examinations, leveraging blockchain analytics platforms to trace fund flows, identify taint clusters, and reconstruct the attack surface topology. By institutionalizing cross‑industry information sharing agreements, the sector can cultivate a dynamic security posture that adapts in real time to emerging threat vectors, thereby fostering an ecosystem that is both resilient and trustworthy for end‑users and institutional participants alike.

It is disheartening to witness how a lapse in basic security protocols can jeopardize the trust of countless users, yet the swift collaboration demonstrated serves as a reminder that ethical responsibility must outweigh competitive ambition.

Honestly, the way the community rallied-Bitget lending Ether, Crypto.com sharing tools, Hacken providing audits-shows that we can put users first when it matters most 😊. It’s a good sign that even big players can act responsibly, and I hope this sets a new standard for handling future incidents. Let’s keep the momentum going!

So basically the hack was a wake up call for everyone and the way folks stepped up shows we’re stronger together in this crypto world