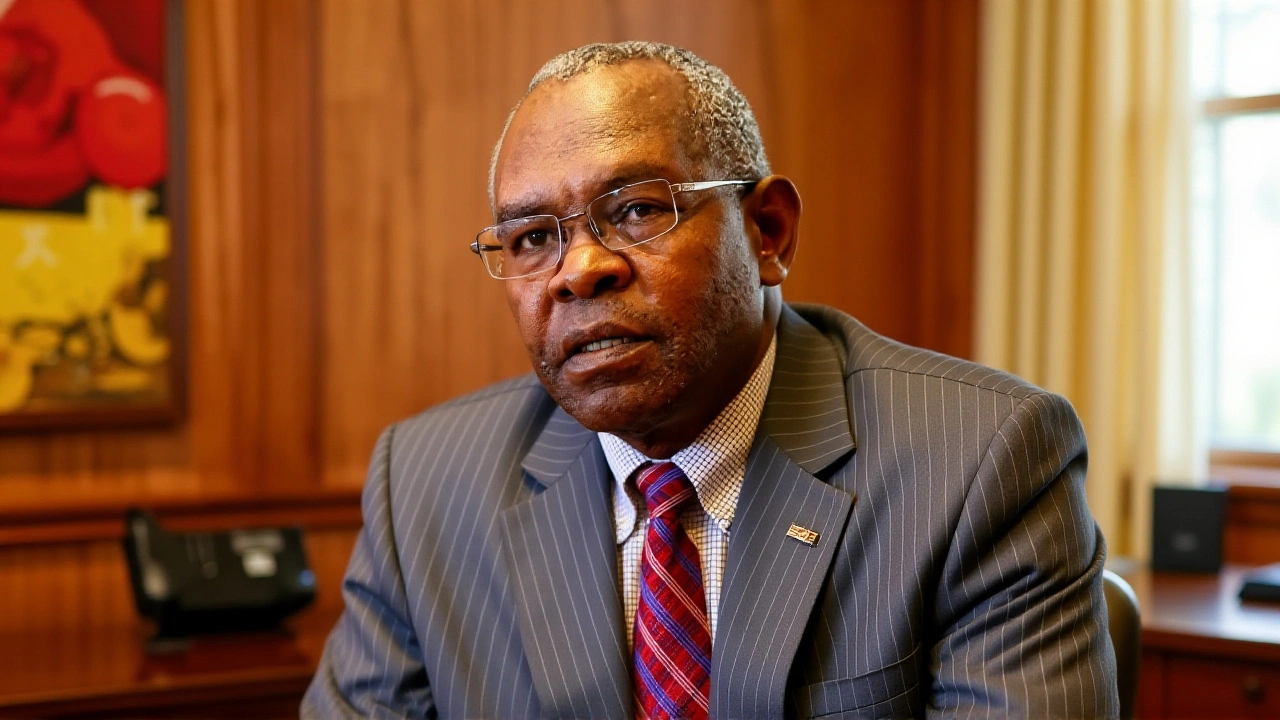

On 1 February 2025 Kenya rolled out a steep hike in NSSF contribution rates, the third phase of the 2013 Act that governs the National Social Security Fund. The move was unveiled by Mohamed Yusuf Haji, Minister of Labour at a press conference in Nairobi, and it marks the most significant shift in Kenya’s pension landscape in a decade.

Background to the NSSF Reform

Since the passage of the NSSF Act in 2013, the fund has operated under a flat‑rate contribution model that many economists argued left higher earners under‑contributing. The government’s five‑year social security plan, approved by Parliament in 2020, set out three implementation phases designed to broaden coverage and improve retirement payouts. Phase I (2022‑2023) introduced a modest increase in the lower earnings bracket, while Phase II (2023‑2024) raised the ceiling for compulsory participation. Phase III, now in force, doubles the upper earnings limit from KSh 36,000 to KSh 72,000 and adjusts the contribution bands accordingly.

During NSSF Contribution Rate Revision 2025Kenya, the minister stressed that the changes are not a tax hike but an investment in workers’ future security. The government estimates that, over the long term, the revisions could increase average pension payouts by roughly 30 %.

Details of the New Contribution Structure

The revamped scheme now applies to all employees aged 18 to the retirement age who are covered by the Employment Act. The lower earnings limit for contributions rose from KSh 7,000 to KSh 8,000, while the upper limit was set at two times the national average salary – KSh 72,000. As a result, the minimum monthly employee deduction increased from KSh 420 to KSh 480, and the maximum employee contribution jumped from KSh 2,160 to KSh 4,320.

Because contributions are split equally between employee and employer, the total maximum monthly outlay for salaries between KSh 80,000 and KSh 500,000 now stands at KSh 8,640. To illustrate, a worker earning KSh 50,000 will see a KSh 3,000 deduction (up from KSh 2,160), while someone on KSh 72,000 will pay KSh 4,320 – exactly double the previous amount.

Tier I of the fund remains a flat KSh 480, covering basic pension benefits, whereas Tier II – the provident component – now sits at KSh 3,840 for the average earner. The two‑tier model ensures that all contributors receive a minimal pension while higher earners build a larger retirement nest egg.

Reactions from Employers and Workers

Employers have expressed mixed feelings. The Kenyan Employers Federation issued a statement noting that the higher outlay will tighten cash flows for small and medium‑size enterprises, especially those already grappling with inflation‑driven wage pressures. However, the federation also welcomed the move as a step toward aligning Kenya’s social security system with regional standards.

Workers’ unions, meanwhile, are urging the government to pair the contribution hike with stronger enforcement of the fund’s investment policies. Kenyan Workers’ Union spokesperson Grace Njeri said, \"Higher deductions are acceptable only if retirees see real, timely payouts. We need transparency on how the NSSF is investing these extra shillings.\"

For low‑income earners, the impact is more immediate. A cashier pulling in KSh 9,000 a month now sees a KSh 30 reduction in take‑home pay, a non‑trivial bite when food prices are climbing. Yet the same worker will, over a 30‑year career, accrue roughly KSh 1.1 million more in retirement benefits than under the flat‑rate system, according to a KPMG impact analysis released last week.

Economic and Social Implications

Analysts at KPMG suggest that the reform could boost domestic savings rates by 0.8 % of GDP, as more wages are funneled into the fund’s relatively low‑risk investment portfolio. Over the next decade, the NSSF’s asset base is projected to cross KSh 2 trillion, enhancing its capacity to finance infrastructure projects such as the new standard gauge railway extensions.

Critics warn, however, that the success of the scheme hinges on strict compliance. The NSSF’s own audit report from December 2024 flagged a 4.7 % delay rate in employer remittances, a figure that could rise if businesses find the new thresholds cumbersome.

From a social perspective, the higher contributions are expected to reduce old‑age poverty. The World Bank’s 2023 Kenya Poverty Assessment estimated that 16 % of retirees live below the national poverty line. By raising the contributory floor, the government hopes to shrink that share to under 10 % by 2035.

Implementation Timeline and Next Steps

Employers were instructed to adjust payroll systems by 31 January 2025, with the first mandatory remittance due on 9 February. The NSSF will conduct quarterly compliance checks and has pledged to issue electronic reminders to firms that miss the deadline.

Phase IV of the reforms, slated for 2026, will introduce a voluntary third tier aimed at high‑income professionals who wish to augment their retirement savings beyond the mandatory caps. The government also plans to launch a public awareness campaign, partnering with local radio stations and the Kenya Financial Literacy Programme, to educate workers on the long‑term benefits of the new structure.

Meanwhile, the Labour Ministry has opened a dedicated helpline – 0800‑NSSF‑HELP – to field queries from both employers and employees during the transition period.

Frequently Asked Questions

How will the new NSSF contribution rates affect low‑income workers?

Workers earning below KSh 10,000 will see a monthly deduction rise from KSh 30 to KSh 48, cutting take‑home pay by roughly 1‑2 %. Over a 30‑year career, however, the higher contributions could add about KSh 1.1 million to their eventual pension, according to KPMG estimates, helping to narrow the retirement‑income gap.

What are the obligations for employers under the revised scheme?

Employers must match the employee’s 3 % contribution, remit the combined amount by the 9th of each month, and file an electronic compliance report via the NSSF portal. Failure to pay on time attracts a 5 % penalty plus interest, and repeated breaches may trigger investigations by the Labour Ministry.

When will the next phase of the NSSF reform be introduced?

Phase IV is slated for early 2026 and will feature a voluntary third tier that allows high‑earners to contribute up to 8 % of their salary. The government expects to roll out guidelines by September 2025, followed by a public consultation period.

How does Kenya’s increase compare with social security contributions in neighboring countries?

Uganda’s NSSF caps employee contributions at 5 % of earnings, while Tanzania’s scheme tops out at 2 % for both employee and employer. Kenya’s 6 % split (3 % each) and higher caps place it at the more progressive end of the East African spectrum, aligning it closer to South Africa’s tiered model.

What role is KPMG playing in the transition?

KPMG has been hired by the Ministry of Labour to produce implementation guides, run webinars for payroll officers, and audit a sample of firms to ensure compliance. Their impact study predicts a 0.8 % rise in national savings as a direct result of the contribution hike.

Comments

Sure, another "investment" that sounds great on paper but actually squeezes the little guy harder than ever 😒.

Look, the math is simple: double the cap means double the outlay for firms and double the bite for workers. It’s not a charity drive it’s a forced savings scheme. The government says it’s for our future but the present feels a lot tighter.

Kenya’s decisive reform exemplifies the sovereign economic vision that many African nations lack; by raising contribution ceilings it asserts fiscal responsibility and aligns with global best‑practice standards, thereby strengthening national resilience.

From a macro‑economic perspective, the upward adjustment in the NSSF payroll tax base will augment aggregate savings rates, potentially catalyzing a modest fiscal multiplier effect as increased fund inflows enhance capital market depth and infrastructure financing capacity.

One might argue that the ethical imperative to secure dignified old‑age provisions supersedes any short‑term discomfort, yet we must also interrogate whether the state’s custodial role is being exercised with requisite transparency, accountability, and prudence-principles that ought to undergird every fiscal undertaking.

The revised contribution schedule, while ostensibly progressive, introduces compliance complexities that could strain SMEs unless mitigated by targeted advisory support from the labour ministry.

It’s just more money taken out of my paycheck, but maybe it’ll help me later.

Indeed, the collective benefit should outweigh the immediate inconvenience; solidarity in social security is a cornerstone of societal cohesion.

Let’s keep the conversation constructive 😊 – the fund’s growth could mean better retirement outcomes for many.

The NSSF overhaul, as delineated in the February 2025 decree, unfolds a multilayered tapestry of fiscal recalibration that warrants meticulous scrutiny. The upward revision of the contribution ceiling from KSh 36,000 to KSh 72,000 ostensibly aligns Kenya with regional peers, yet it simultaneously imposes a non‑trivial incremental burden on both payroll processors and end‑employees. In practice, firms will need to retrofit their accounting systems to accommodate the bifurcated 3 % matching contribution, an undertaking that may divert scarce resources from core operational activities. Moreover, the statutory requirement that employers remit the consolidated sum by the 9th of each month introduces a cadence that could exacerbate cash‑flow volatility for businesses already navigating inflationary pressures. From a macro‑economic standpoint, the projected 0.8 % uptick in national savings is modest, and the assumption that this will translate into a commensurate expansion of the NSSF’s investment portfolio remains speculative absent robust governance reforms. The audit report’s revelation of a 4.7 % delinquency rate in employer remittances underscores systemic compliance challenges that could be amplified under the new regime. While the Ministry of Labour touts the reform as an “investment in workers’ future,” the immediate distributional impact disproportionately affects low‑wage earners whose marginal propensity to consume is high, thereby potentially dampening aggregate demand. Critics also highlight the opacity surrounding the fund’s asset allocation, calling for heightened disclosure standards to ensure that the additional contributions are stewarded prudently. In sum, the policy initiative embodies a paradox: it aspires to fortify social safety nets while imposing short‑term fiscal strain, a balance that will only be vindicated through rigorous implementation oversight and transparent performance reporting.

The changes look big but they might not be that scary for most companies.

Sounds like more paperwork.

From a policy analysis lens, the recalibration of contribution thresholds introduces a progressive fiscal lever that, if calibrated correctly, could attenuate retirement poverty rates while preserving labor market elasticity.

Wow, this is a game‑changer! Imagine the peace of mind knowing you’ll have a solid nest egg when you finally decide to stop working – it’s like planting a tree today and watching it give shade tomorrow.

It’s important we view this reform as a collective step forward, acknowledging the challenges while supporting one another through the transition.

While the adjustment may present short‑term hurdles, the long‑term uplift in retirement security stands as a testament to prudent fiscal stewardship; let us stay optimistic and work collaboratively to ensure smooth implementation.

Implementation details seem thorough, though the practical impact on workers warrants close observation.

The reform’s efficacy will ultimately hinge on enforcement rigor and transparent fund management, not merely on headline numbers.